Feb 14, 2025 | Buying a Home, Selling Your Home

We’re often asked, “How’s the real estate market?” We’re pleased to share the latest data with you that has been compiled for Dorchester, Talbot, and Wicomico Counties.

Overall, the current market reflects that buyers and sellers are adjusting to the ‘new normal’ of 30-year fixed rate mortgage rates between 6% and 7%. Although these rates seem high compared to the 2010 – 2022 timeframe, they are still historically low, as shown in this interactive FRED chart. The following reports show that, generally speaking, there weren’t substantial changes in the local real estate market in 2024 as compared to 2023.

As you prepare to buy or sell your home, it’s a good idea to familiarize with the data in these reports. It will give you a sense of what to expect. Our Realtors are happy to discuss these data with you as part of your overall buying and/or selling strategy. Please don’t hesitate to contact us to get started. We love our jobs, and we’re happy to help!

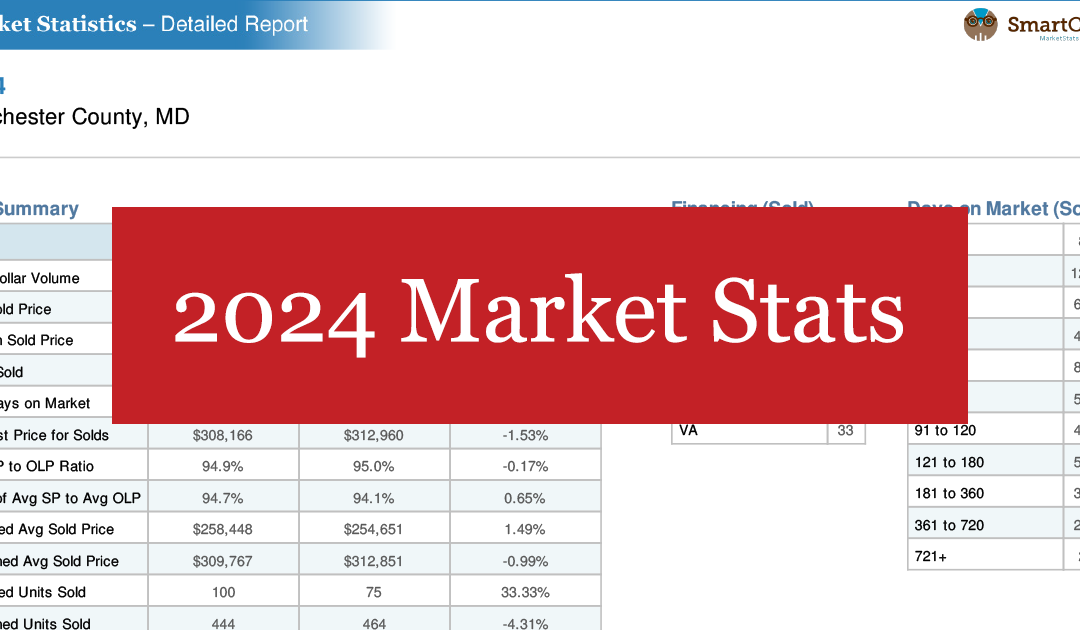

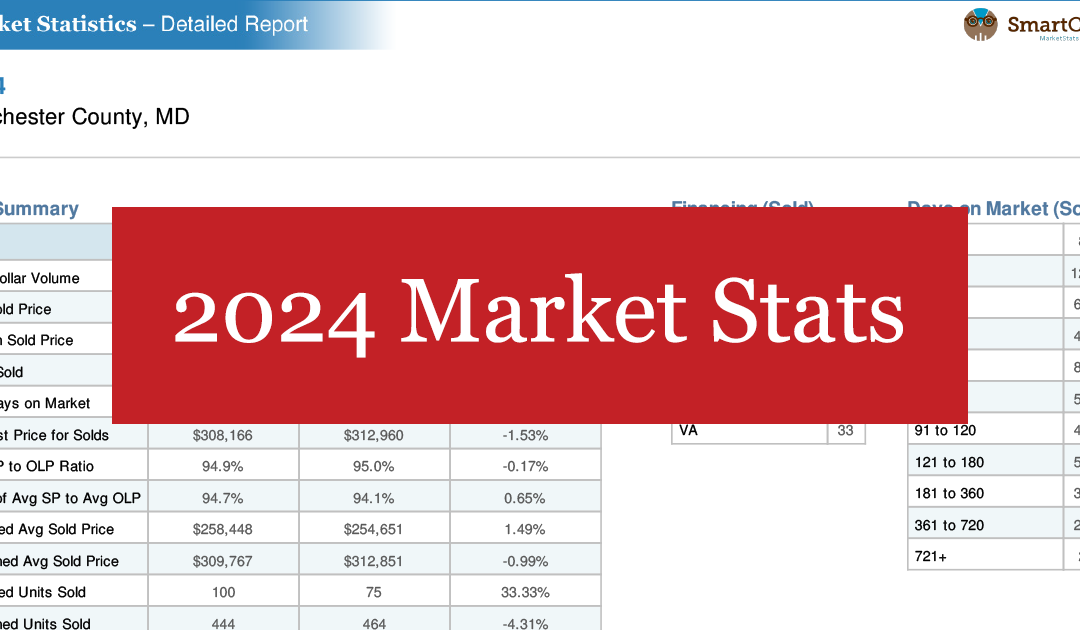

Dorchester County 2024 Real Estate Market Stats

Click here to view the PDF or click the image below.

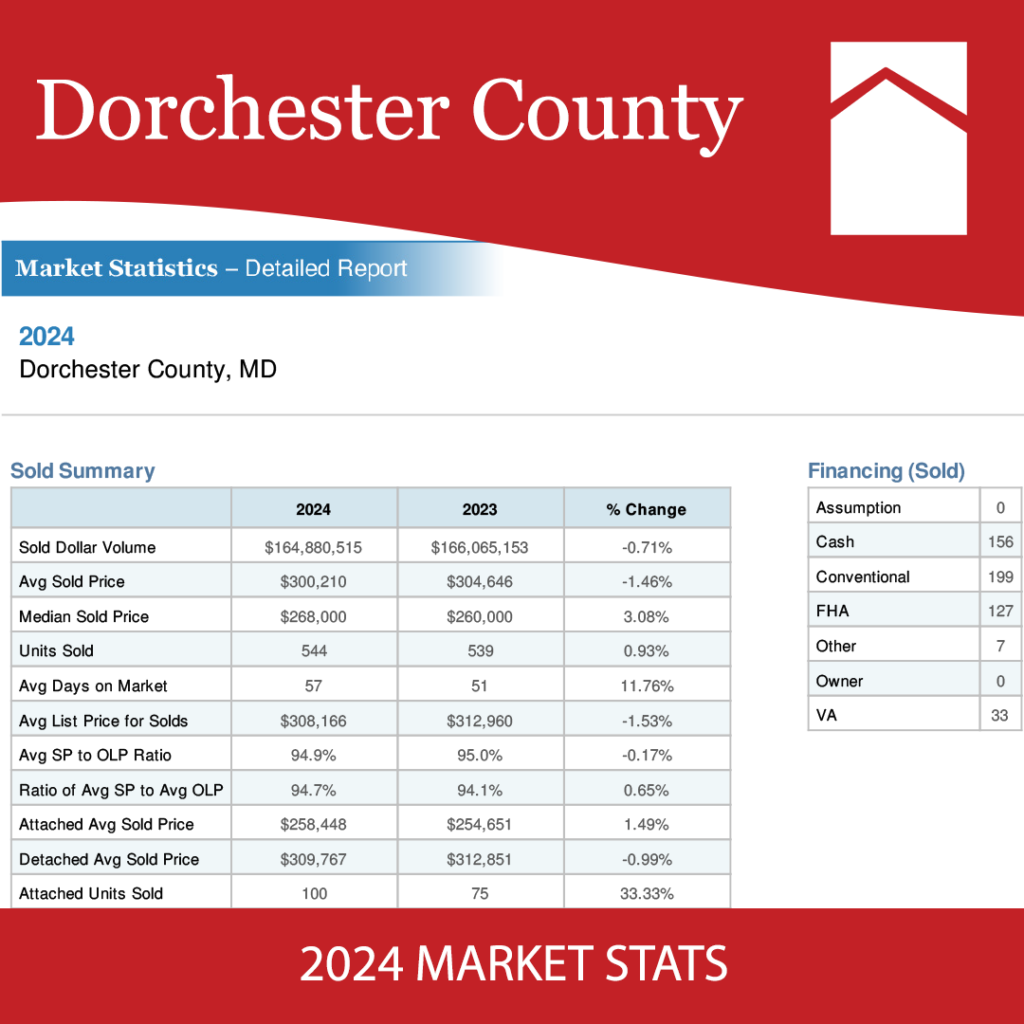

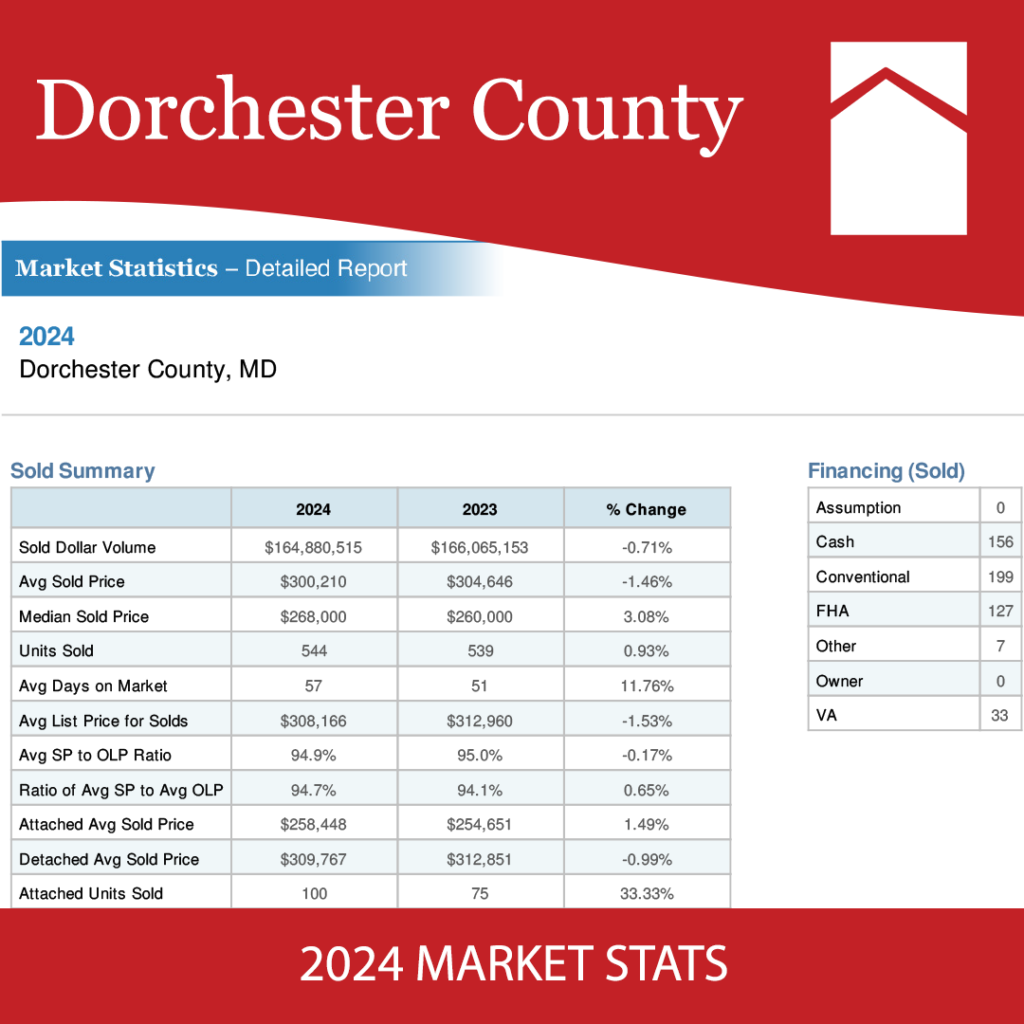

Talbot County 2024 Real Estate Market Stats

Click here to view the PDF or click the image below.

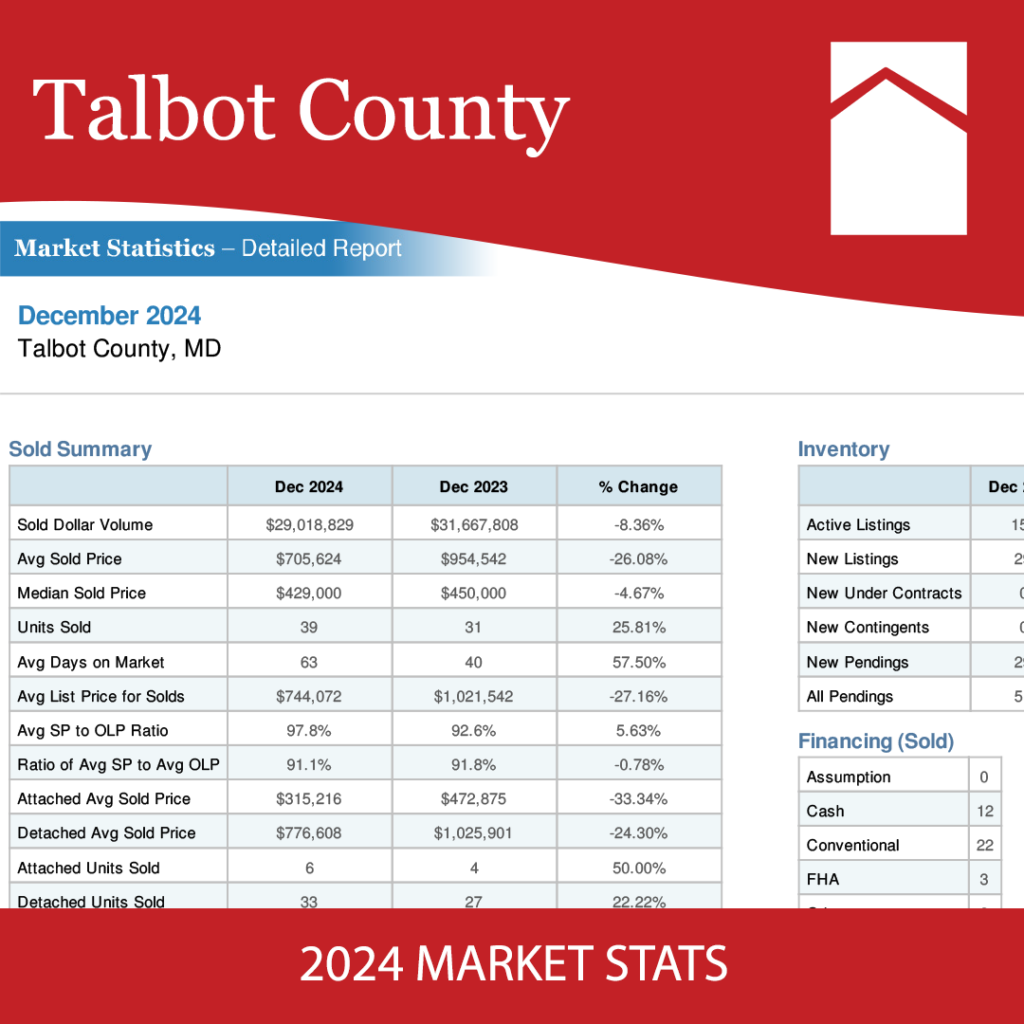

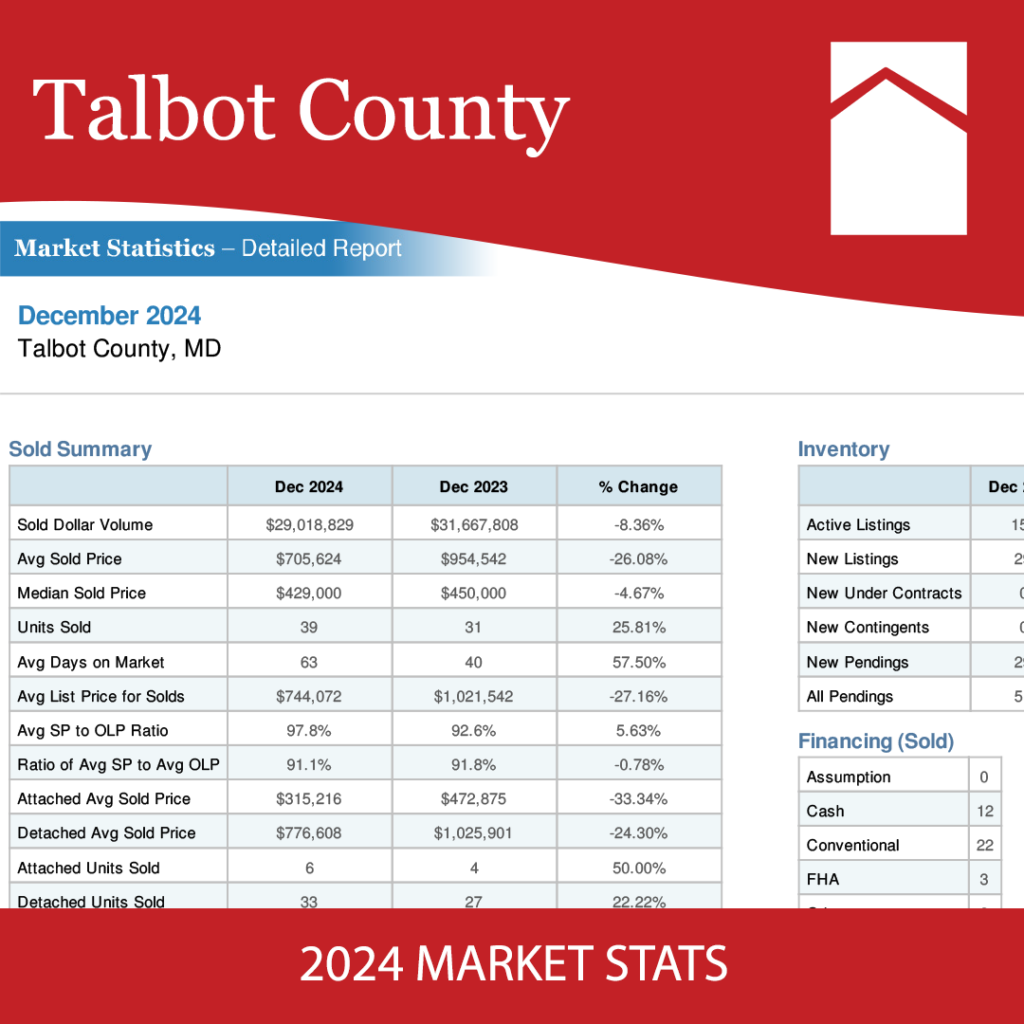

Wicomico County 2024 Real Estate Market Stats

Click here to view the PDF or click the image below.

May 27, 2019 | Buying a Home

Buying a house is one of the most significant and expensive purchases made in a relationship. This decision can be stressful, especially for couples with little to no experience in the field of real estate. There are many decisions to be made while house hunting, from the location of the neighborhood to the size of the master bath. Following these five helpful tips will allow couples to navigate the process of house hunting without straining your relationship!

Tip #1: Communicate with Each Other

Get on the same page. Owning a house together is a big commitment and responsibility. If you’re a couple looking to own a home and possibly expand your family, it’s important to agree on the list of “must haves” before you start your search. Understand what each of you are looking for, whether it’s the spacious backyard and pool, or a basement home theater.

Like most things in a healthy relationship, a successful house hunt depends on communication and compromise. Support one another and try not to pressure each other into a decision that may lead to regret or resentment in the future.

Tip #2: Have a Budget – and Stick to It!

Buying a house is a major financial commitment, and we all know money can be one of the biggest sources of strain in a relationship. Overspending is a surefire way to damage your relationship, both financially and emotionally. Stay within your budget. Consider each other’s income and savings, then consider how you’ll maintain the lifestyle you want once you buy your new home. Don’t get in over your head.

It’s also important to be sure you’re prepared for emergencies. Home ownership can entail unforeseen costs, like fixing a broken heat pump or replacing a rotten floor joist. And don’t forget to consider smaller costs like your monthly bills, the cost of your daily commute to work, and the overall cost of living in your neighborhood. Making sure you have a full understanding of the cost of home ownership will help you and your honey make a smooth transition into your new home.

Tip #3: Get Pre-Approved for a Joint Loan

Finalizing your budget is one step, but seeking pre-approval for a loan is key in speeding up the buying process. Once you’re pre-approved, your realtors and mortgage company will be confident that you are financially stable and able to purchase the house you’re requesting to view. When it’s time to sign a contract, being pre-approved and having a bank commitment letter will help everything go much more smoothly.

Married couples will typically apply for a loan together. If you’re not married, you can still apply for a joint loan, but do some research first to understand the legal and tax implications. And never put your name on a home loan unless your name is also on the deed of the house!

Tip #4: Get a Home Inspection – Always!

Never skip the home inspection! Sometimes one person in a couple is so excited about buying a home that they want to rush through this critical step. Don’t do it! Help your partner understand the importance of an inspection. You need to know what you’re getting into. You don’t want to be surprised that your septic system has failed after closing on your house, or find that the back deck is infested with termites while hosting your very first house warming party.

Again, money and finances are the most common source of problems in relationships. Skipping a home inspection opens up a financial can of worms. Even if a home is being sold “as is,” you should get an inspection. The inspection report will give you an idea future costs you’ll incur, and you can use this information to plan your offer.

You’ll save yourselves a lot of stress – and money! – if you insist on a home inspection.

Tip #5: Don’t Sweat the Small Stuff

As a couple, you may not agree on all aspects of the house, from the carpet in the living room to the tile on the patio. But these are details that can be smoothed out later. You want to make sure you’ve picked a house that fits the needs of your future together. Do you need that extra spare room for the future expansion of your family? Is the kitchen spacious enough to host family dinners? If you both can agree on a house that covers everything on your “must have” list, the smaller details can be settled in the future.

The truth is, couples usually don’t agree on design choices and how to customize their home. However, once you’ve owned your home for a while, you’ll have a better sense of how you use your space and what your design or renovation preferences are. Over time, you can work together to plan and save for any upgrades on each other’s wish lists.

The most important thing about house hunting as a couple is to always remember that you are in this together! You aren’t just buying a home together; you’re investing in your future together as a couple and family. Be patient. The right house will come along. Enjoy exploring the possibilities together. Happy house hunting!

Start your home search here. Contact us if you’d like to speak with one of our experienced Realtors.

May 7, 2019 | Buying a Home

So you’ve decided you want to buy a house… Congratulations! Buying a home can be incredibly rewarding – both financially and personally. In the 40+ years we’ve helped people find their homes, we’ve learned that there’s definitely a right way to approach your home search. Read on for our eight top tips for a successful home search.

Tip #1: Figure out your finances first

Before you do anything else, figure out how much you can comfortably spend on your new home. Go through your monthly budget and your savings. Figure out how much more you need to save and how long it will take.

Once you have a handle on your finances, get pre-qualified for mortgage. You’ll submit an application to a lender, along with all necessary documentation. The lender will evaluate your application and let you know what type of loan you’ve qualified for. You’ll know the maximum amount of the loan, the down payment requirements, and the interest rate. Keep in mind that you may qualify for more than you actually want to spend. Stick to your budget once you begin shopping!

Tip #2: Start your search online

You can use online home search tools to get a general sense of the types of homes available in your area and their pricing. This will help you understand the types of homes available within your price range. Take notes on what you like and don’t like about the homes that fall within your budget.

It’s also helpful to invite your spouse, friends, and family to join your online search. When you create a free search account on our site, you can create a saved search that meets your criteria. Then, you can invite others to join your search. You can share reactions and comments privately within your search party. This saves a lot of time and helps get everyone on the same page (and it’s fun!).

Tip #3: Explore the neighborhoods you’re considering

Visit the neighborhoods you’re considering – both in the car and on foot. Get a sense of whether or not they feel like a good fit with your personality and lifestyle. See how far they are from your work, shopping, restaurants, and other conveniences. It’s also a good idea to visit neighborhoods at different times of day. You want to make sure the neighborhood vibe doesn’t change dramatically at night.

Once you’ve honed in on a few neighborhoods, go back online to check home prices. Location can have a huge impact on pricing, so you may not be able to get as much house in a sought-after neighborhood.

Tip #4: Make a list of must-haves and would-like-to-haves

Now that you’ve done your research about what you can realistically expect within your budget, start making lists. Try to keep your must-have list limited to just three of four things. These are the things that you cannot or will not compromise on. Try to be flexible on everything else. Your “would-like-to-haves” list are things that you can give up or trade off to get your must-haves.

Tip #5: Meet with your Realtor to discuss your goals and develop a clear strategy

Share your budget and your must-haves and would-like-to-haves lists with your Realtor. Discuss the neighborhoods you’d like to target. Discuss your timeline for buying a home. Ask lots and lots of questions about the process of touring homes, putting in an offer, and closing on a home. Then, agree on a strategy and let the searching begin!

(Need help finding a great Realtor? We have more than a dozen fantastic Realtors on our team. You can also read this post about how to choose the right Realtor.)

Tip #6: Start touring homes and provide LOTS of feedback to your Realtor

All the research and legwork you’ve done up to this point will help your Realtor identify the right kinds of homes for your needs. Start touring the homes and take lots of notes about what you see. Share feedback with your Realtor about what you liked and didn’t like about each home. The more specific your feedback, the better. Your Realtor will use this information to further hone in on just the right home for you.

Tip #7: Put in a fair offer

When you find a home you love and you’re ready to put in an offer, sit down with a Realtor and discuss your strategy. Your Realtor will provide comps (recent sales of comparable homes), which will give you a better sense of the market value of the home you’ve chosen. Put in an offer that is fair and reasonable based on market value. It’s okay to leave a little wiggle room to negotiate, but don’t low-ball your offer. This can insult sellers and make them unwilling to work with you. It can also send a signal that you aren’t serious or aren’t properly informed, and again, sellers may be unwilling to work with you.

If your offer is fair and based on market research, you should be able to reach an agreement that works for everyone.

Tip #8: Get a home inspection

This is so important! Make your offer contingent upon a successful home inspection. If a problem is discovered, you have a few options. You can walk away from the property if it seems like too much to deal with. Another option is to negotiate that the seller will fix the problem prior to closing and provide proof that the work was done. Or, you can negotiate a lower selling price and take care of the work yourself after you’ve purchased the home.

Bonus tip: Use your Realtor’s expertise every step of the way!

You can engage a Realtor as early in this process as you’d like. If you’d like to get their input on how to figure out your finances, feel free to ask for their help. If you’d like them to narrow down your initial online search, they can do that for you. Your Realtor’s job is to make sure you understand the process and ultimately choose the perfect home. You can’t ask too many questions… A good Realtor is always happy to help!

Aug 9, 2018 | Buying a Home, Selling Your Home

Repairs and maintenance are a reality of home ownership. There are some jobs that are definitely best left to the professionals, but there are many repairs you can do yourself. Mastering a few simple DIY home repair techniques will save you a lot of money in the long run. Here, we share a few of our favorite tips and resources for DIY home repair.

Kitchen Home Improvement & Repairs

How to Fix a Clogged Sink

It is quite common for food to get clogged in the sink. To clear the path, you can take a plunger to try and suction the particles out of the drain. If pesky particles are remaining, make a baking soda and vinegar mix to unclog the sink.

How to Fix Burns on Laminate Countertops

Hot pans can do serious damage to laminate countertops. Large burns will call for a replacement, but minor burns are a simple fix. First, start by scrubbing the area with steel wool or a rough material like sandpaper, then create a homemade abrasive cleaner (baking soda and water) to remove all excess material.

Check out other great kitchen repair tips at the DIY Network blog!

Bathroom Repairs & DIY Renos

Planning & Managing Bathroom Renovations

Whether your vision for your bathroom involves tile, vinyl, wallpaper, or paint, this book will ensure you are repairing and remodeling your bathroom like the professionals. It also includes steps for planning out your project and finding fixtures that fit! This is a great beginner’s guide to bathroom renovations.

Bathroom Remodeling for Dummies

How to Fix a Broken Faucet

Make sure when fixing a broken faucet, you have a replacement at the ready! Also, ensure your water is turned off and you put a stopper over the drain to keep any pieces from falling into the pipes. These are the basic things you need to do to prep your bathroom for a faucet repair or replacement. Check out these handy videos on how to actually tackle the job!

Repairing a Leaky Faucet

How to Replace a Bathroom Sink Faucet

Keeping Every Room Beautiful

How to Paint Like a Pro

Nothing makes your home feel cleaner than a fresh coat of paint! It’s incredible what a difference a fresh paint job can make. It’s one of the easiest, most affordable, and most dramatic home improvements you can make. Check out this article about how to paint a room like a pro!

Top 10 Ways to Paint Like a Pro

How to Change Out Lights Fixtures

Light fixtures are like jewelry for your house! Updating ceiling fixtures can make a HUGE difference in your home. Light fixtures may seem difficult to replace, but this video will teach you how to do it step-by-step. It’s much easier than you’d expect!

How to Replace a Ceiling Light Fixture

How to Replace Doorknobs & Cabinet Hardware

Okay, doorknobs and hardware are ALSO the jewelry for your home! This is another simple change that can make an amazing difference. Few things can cause a home to look as dated as doorknobs and hardware. To change out cabinet hardware, just unscrew from the back side of the cabinet door, pop in the new one, and tighten. Replacing a doorknob is almost as easy!

How to Replace a Door Knob

Bonus tip: If your cabinet hardware is a dated color or finish, you can give it a SUPER affordable update with spray paint! Just remove the hardware and give it 2 – 3 coats. Let everything dry thoroughly before reinstalling.

DIY Outdoor Spaces

How to Repair Chipped Outdoor Paint

When your exterior color begins to crack, it’s not just unsightly; it’s a sign that your interior and exterior walls may be compromised. Any exposed wood can start to rot and decay, leaving your home vulnerable to moisture and pests. Pressure washing your house will get rid of chipped paint and will allow you to create a new coat to avoid the wood becoming molded. Check out this link for other important exterior maintenance tips!

6 Must-Do Outdoor Spring Home Maintenance Tasks

Weeding Out the Weeds

Getting rid of weeds is one of the simplest and most dramatic ways to improve your curb appeal. The best solution is to pull weeds out by the roots to make sure they don’t continue to grow. Pre-emergent herbicides can help prevent weeds from sprouting without doing damage to your lawn. Specific tools are more manageable for different types of weeds because of the way the root structures grow. Check out this article about determining which device works best for your needs.

Tips & Tricks for Eliminating Lawn Weeds

6 Cases When you Should Hire a Professional

Photo source: https://www.bidvine.com/

Installing Crown Molding

This may seem like an easy DIY, but you should leave this to the experts. There are dozens of different angles you’ll have to consider and your math has to be exact. Save yourself a LOT of frustration and call in a pro!

Replacing Windows with French Doors

This job requires a lot of specialized materials and tools. You also have to consider how to keep the wall structurally sound during the replacement. Finally, you may have electrical wires that need to be rerouted to accommodate the new doors. Because of this, this project is best left to the experts.

Removing a Load-Bearing Wall

Knocking down walls should be left to the pros. Structural changes in your home require tons of planning. A licensed contractor is familiar with this procedure and will get the job done right.

Replacing an Old Driveway

There is a lot to consider when replacing an old driveway. This is hard work that requires specialized equipment. A small miscalculation may be costly, so play it safe and hire a professional.

Building a Pergola

Building a pergola involves site planning and understanding local code requirements. It also involves digging and setting concrete footers, which is no easy task for most homeowners.

Waterproofing Your Basement

Every home is unique, and no one game plan for waterproofing your basement that will work in every house. There are different approaches that professionals will recommend based on your home’s unique challenges.

We hope these resources are helpful to you! If you’re ready to tackle home ownership and all it entails, give us a call or send us a message. We’d love to help!

Mar 21, 2018 | Buying a Home

Every house has the potential to become a dream home! Thanks to popular television shows today, more people are realizing that fixer uppers may be more cost effective and less time consuming than building a house from the ground up. Fixer uppers also present an opportunity to turn a profit: improving a home and flipping it for resale has been a successful strategy for many Eastern Shore investors.

Eastern Shore real estate is one of the best markets for flipping houses because there are so many great structural homes built on prime land along the water, near the beaches and in growing towns. There are countless reasons to fix up a home in Maryland; whether it’s to design your own kitchen with a few changes, save money on land or take your time while living in the home. But the biggest reason is to flip the house as an investment property.

Not only can you make significant returns on your investment by house flipping on the Eastern Shore, you can do it relatively fast if there are no major setbacks. We recommend working with a good inspector before you purchase the house to make sure there isn’t significant damage, and working with a good contractor during the flipping process. (Contact us for recommendations on local inspectors and contractors).

Most companies or people who flip homes as a business suggest that you focus on the neighborhood where the house is located as much as you focus on the features of the house itself. Luckily for you, most real estate on the Eastern Shore is in good neighborhoods within 30 minutes of a body of water! Couples are moving here more now than ever to raise their children and retire because of the quiet rural lifestyle and safe, family-friendly environment.

Another reason flipping homes on the Eastern Shore is a good investment is because the cost of buying a house is less expensive compared to other areas of Maryland, Delaware, Virginia and Pennsylvania. The Eastern Shore is becoming a popular destination for commuters working in Annapolis, Baltimore and D.C. When fixing up a house to sell, you want a house to which you can add value and sell for more than you spent. The value will continue to increase for Eastern Shore homes as more families choose to move here to raise their families and drive further for work.

If you’ve got access to cash, good credit and the will to put in the hard work, fixing up houses to sell as investments can be a smart strategic move. The best part about this process is that the more homes you flip, the more familiar you become with construction costs, design trends and reliable contractors, and the easier it becomes.

Not sure where to start on buying a house to flip? We can help! It’s important to discuss the details with experts regarding which improvements to make depending on the value of surrounding homes, the age of appliances, the outdated features, etc.

With access to numerous listings, local home design and appliance businesses, and the knowledge of what buyers are looking for in certain areas, you can’t go wrong with our team at Powell Realtors. Contact us today to find your first fixer upper or house to flip for investment!

Feb 27, 2018 | Buying a Home

The increase in Americans renting homes today is undeniable. Investing in rental properties can be very economical for homeowners for many reasons. Not only can rental properties help accumulate long-term wealth, they also prepare a financially stable future and diversify investment portfolios.

The increase in Americans renting homes today is undeniable. Investing in rental properties can be very economical for homeowners for many reasons. Not only can rental properties help accumulate long-term wealth, they also prepare a financially stable future and diversify investment portfolios.

According to Trulia, there has been a significant increase in the number of Americans who rent their homes in the last 10 years. A recent report examines growth in renting versus owning across the U.S., as well as the rise in rental housing prices between 2006 and 2014. Because increasing student loans are making qualifying for a mortgage more difficult, the demand for rental properties will only grow over time.

The Eastern Shore is going through a bit of a renaissance in many towns with new people moving in and renting homes. There’s a high demand for downtown housing that’s close to restaurants, shops and the water, so it’s the perfect time to make a real estate investment. Eastern Shore real estate is booming when it comes to rentals, and we know the benefits.

We’ve gathered the top 5 reasons you should invest in rental properties on Maryland’s Eastern Shore:

1. Stability

Unlike the latest tech trend or start-up company, real estate is an investment that will last. The beauty of rental properties is that people will always need a place to live, so the demand will never end. And we know from experience that most people who come to the Eastern Shore immediately feel at “home” and choose to stay to raise families and enjoy the rural lifestyle.

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.” Franklin D. Roosevelt

2. Tax Benefits

Renting out your home has numerous tax benefits. You can write off the interest on your mortgage or credit cards with property purchases, insurance, maintenance costs, travel expenses and even property taxes as a rental property owner. In the midst of Tax Season right now, think of how great it would be to write some of those things off!

3. Income

As long as your rental property is occupied with tenants, you can receive a steady stream of income while also paying down your mortgage. You’re your own boss. You get to choose which property to invest in, which tenants you will rent to, how much you will charge for rent, and how you’ll manage the property as a whole. Plus you don’t have to be present all the time to make money!

4. Leverage

You can use a bank loan or private lending to purchase a property and increase the potential return. You don’t need 100% of the property purchase price (wow, say that 3 times fast!) to buy it, allowing you to buy more than you could in stocks or other investments. Your time and abilities can also be leveraged to make the home or property as nice as you want, increasing the rental price!

5. Easy to Begin

It’s not very difficult to turn your home or property into a rental, especially if you consult with a real estate agent. We can walk you through how to price your property and write a lease. We can also recommend property managers if you’d rather not be the landlord, and we even help you find potential tenants!

If you’re interested in purchasing a home or making yours a rental, shoot us a message or give us a call at 410-228-9333!

The increase in Americans renting homes today is undeniable. Investing in rental properties can be very economical for homeowners for many reasons. Not only can rental properties help accumulate long-term wealth, they also prepare a financially stable future and diversify investment portfolios.

The increase in Americans renting homes today is undeniable. Investing in rental properties can be very economical for homeowners for many reasons. Not only can rental properties help accumulate long-term wealth, they also prepare a financially stable future and diversify investment portfolios.